I was talking to my brother back home in India and we came to the topic of “Biriyani”

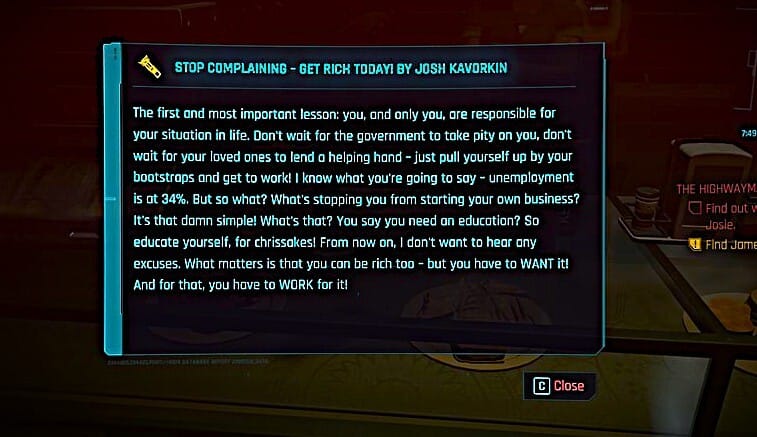

You can Read it I read while Playing Cyberpunk 2077, Found Interesting & Real

Our minds were blown when we realized Biriyani only costed $80, 4 years ago now that’s $170 that’s a Big Jump of price. same goes for everything.

I asked my brother a contrarian question: So, what are you going to do about Purchasing Power going down?

He is like there isn’t much to do and I was like that’s not true there is actually something you can do.

(at that time my mind was like save money, invest, start a business) but that’s not enough in 2025!

Second call was with my Homie in India, same topic (bro purchasing power going down)

He gave me another Blockbuster Mindfuck. People are taking EMIs/Loans to Buy iPhone and getting married (what kind of cluster fuck situation is taking a bank loan to get married)

So, what is the solution for this Problem?

First of all, it’s not overnight solution instead it takes Time. Money / Finance is a big construct from the Human Story. People had it, Governments now it’s with powerful people and Corporations and “YES” they can control its Flow and what people should use it for.

1. Increase Income Streams:

Develop new skills: Invest in education or training to acquire skills in high-demand fields. This can lead to higher-paying jobs or freelance opportunities.

Start a side hustle: Consider starting a small business or freelancing to supplement your primary income. This could involve offering services like tutoring, graphic design, or consulting.

Invest wisely: Explore investment options like stocks, bonds, or real estate to grow your wealth over time.

2. Reduce Expenses:

Create a budget: Track your spending to identify areas where you can cut back. This could involve dining out less, reducing entertainment costs, or negotiating lower prices for utilities and insurance.

Cook more often: Eating at home is significantly cheaper than dining out.

Shop smart: Utilize coupons, compare prices, and buy in bulk to save on groceries and other essentials.

Downsize if necessary: If you have excess space, consider downsizing your living situation to reduce housing costs.

3. Increase Savings:

Automate savings: Set up automatic transfers from your checking account to your savings account to ensure consistent savings.

Emergency fund: Aim to build an emergency fund that can cover 3-6 months of living expenses to cushion against unexpected financial shocks.

Retirement planning: Start saving for retirement early to take advantage of compound interest.

4. Negotiate and Advocate:

Negotiate salary: Research industry standards and negotiate your salary during job interviews or performance reviews.

Advocate for fair wages: Support policies and initiatives that promote fair wages and worker rights.

Join a union: Joining a union can provide collective bargaining power and improve your working conditions.

5. Government Support:

Social safety nets: Utilize government programs like food assistance, housing assistance, and unemployment benefits if eligible.

Tax credits: Explore tax credits and deductions that can reduce your tax burden.

Additional Tips:

Avoid debt: High-interest debt can significantly reduce your purchasing power. Prioritize paying off credit cards and other high-interest loans.

Plan for the future: Consider long-term financial planning to ensure you are prepared for major expenses like education or healthcare.

Stay informed: Keep up to date on economic trends and financial news to make informed decisions.

Ultimate Conclusion: Theme of Mark.III Newsletter - “Escape the Mark of the Beast” the Beast is the Money right in your Bank account trying to Rip you Off. Are you a Bigger Beast than Money. Prove yourself.

Always, always keep this in Mind we are heading to an Amazing Future, keep the Eyes on “Money making Opportunities” be with similar minded people and start a Business Online (only way out)